UPDATE to Contract Lumber’s 2020 Mid-Year Lumber Market Report

Image courtesy of Miller Timber Services, Philomath, Oregon

The pace of change in today’s dynamic environment constantly surprises me. But what has happened in the lumber market in the four weeks since we published our mid-year report, borders on shocking. While at last writing we knew the lumber market had significant momentum, and fully expected lumber prices to continue their climb, the velocity of the ascent has rocked everyone back on their heels. There is a real sense of panic in the market, the likes I have not experienced in the 36 years I have been associated with the industry. The closest would be the spotted-owl fiasco in 1993. Then, the run-up in 2018 created some real angst. And certainly the recession of 2008-2009 was no fun in this business. But, the current situation has a complete different feel – more a hint of desperation. That desperation stems from the scarcity of lumber that is available in the pipeline. With demand churning strongly from the residential construction sector, combined with the unprecedented surge of wood consumption from home centers swamped with COVID-19 related home-bound customers eager to do home improvement projects, lumber producers just cannot keep pace with the current needs of the market. The dearth of available lumber has buyers around the country scrambling for coverage, lapping up every offering a mill puts out there, even if the shipment is six weeks out.

Setting the Stage

The law of supply and demand economics seems quite simple. But the elements and factors that impact the interaction between the producers and buyers of a resource can become quite complex, especially when equilibrium between the two can be so unpredictable, as it is with lumber commodities. The supply-side has been playing catch-up for much of the year. The strength of demand through the three month stretch from December through February of this year, caught many producers off-guard. Housing starts outperformed expectations, and a mild winter allowed work to continue unimpeded for the most part, especially across regions that typically slow down during winter months. As a result, the lumber supply chain, at every level, was unable to build inventory stocks, and prices edged up from mid-December through the end of February.

I won’t revisit all the details of the COVID-19 pandemic since I covered them in our mid-year report. I will say, however, that the coronavirus has certainly played a large part in our current predicament. The initial response from lumber producers was to immediately drawdown production, starting in mid-March. Uncertain about the impact the pandemic would have on lumber demand, roughly 30% of the industry’s production capacity was curtailed. Over 35,000 wood products workers were furloughed around the country, and that does not include statistics from Canadian mills. Over the next six weeks, the lumber market swooned amid the chaos of the pandemic. Even after construction was deemed an essential business in most states, questions about how our shattered economy would rebound were pervasive. Few could imagine the wild ride that was to come.

In mid-April an unexpected upswing developed in the lumber market. Buyers were replenishing depleted inventories and mill order files were starting to extend. Hardly anyone noticed at first, because we were all so preoccupied with trying to manage our new COVID-marred life. By mid-May, the market was running in earnest. Curtailed production was slow to return, and demand ramped up from an unexpected source, big box retailers. Who could have foreseen the surge of DIY projects, tackled by newly sequestered homeowners (with a little extra stimulus cash in their pockets) that would lead to record sales for home centers around the country. The bastions of home center lumber sales – studs, treated, decking, and fencing, all became scarce. Treated lumber was particularly difficult, as southern pine mills struggled to get enough raw production to treaters, and backlogs quickly developed throughout the network. Decking products of any type were almost impossible to find.

At the same time, builders were hard at work, constructing a backlog of sold homes, and to everyone’s surprise, selling new units. Many builders reported hitting their sales quotas during the pandemic, even as models were closed, and buyers were forced to tour homes virtually. New home starts were up month-over-month in May and June, and it appeared that housing was one sector that would not succumb to the COVID-19 doldrums.

Current Realities

Since our 2020 mid-year market report was published on July 1st, the environment surrounding the lumber market has continued to deteriorate. Most lumber mill order files are out well into September as desperate buyers, facing the possibilities of running out of product, snatch up every truckload and carload of mill offerings on the market. Many mills are completely off the market as they contemplate their next move. Log decks are running thin. Buyers are securing future shipments not even knowing what the cost will be because sellers a booking orders as priced time of shipment. And price is secondary to coverage for buyers right now, anyway.

With prices surging, you’d think mills would be adding shifts to take advantage of the milieu. For most, they just don’t have that option. In fact, most are producing at less than capacity because they can’t hire enough workers. The U.S. Bureau of Labor Statistics reports that of the 35,000 wood products workers who were sent home at the beginning of the pandemic, only about 13,000 have returned to their jobs. One reason cited is that with the additional weekly financial bump provided by the federal government, combined with state-level unemployment benefits, some employees are making more money staying at home, and at the same time, not risking contracting the virus from co-workers. It has been exceeding difficult to hire employees in these small rural communities where mills are located even before COVID-19. Now there is even less incentive for them to go to work. It does not appear that relief will be available on the supply-side.

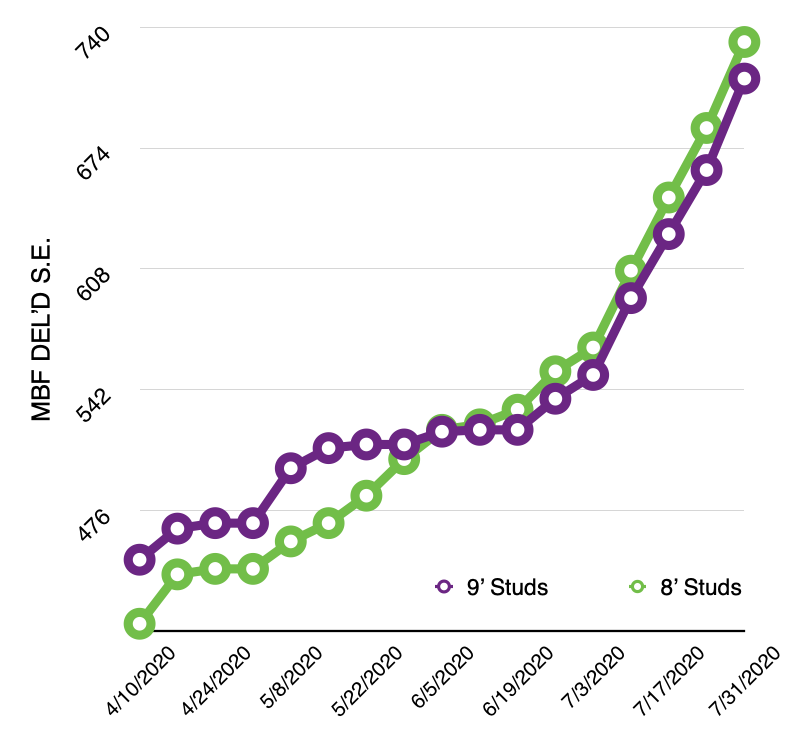

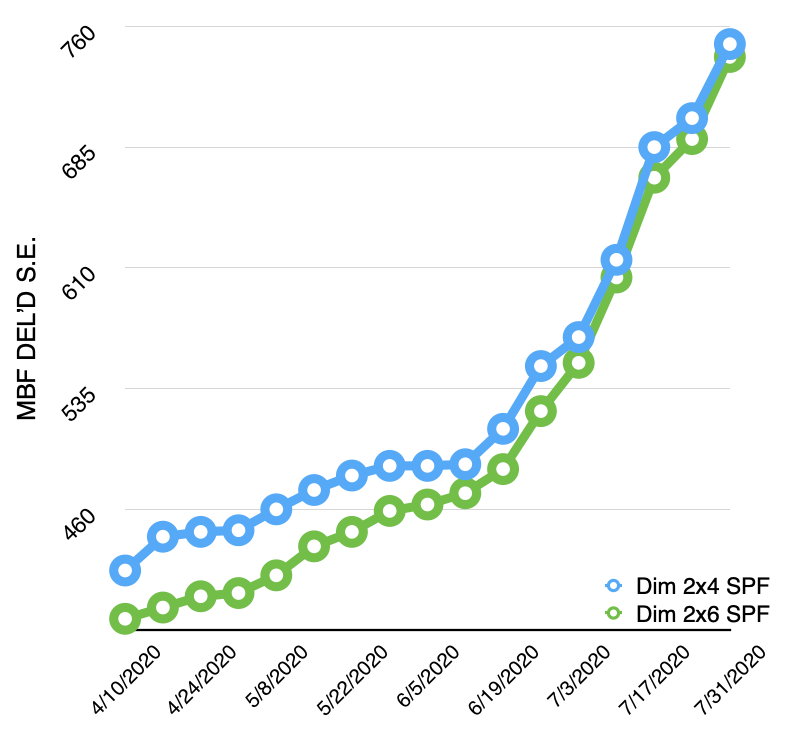

There are several critical product categories to be aware of because they have the ability to slow down jobsite activity. I’ve already mentioned that the demand for treated material has overwhelmed supply, which has also impacted the southern yellow pine market as a whole. Two-by-ten SYP joist are extremely scarce right now, and that has put pressure on 10” production in other species. Strong demand, and limited supply in the stud market has everyone concerned. The Spruce (S-P-F) market out of British Columbia was expected to have challenges with capacity prior to COVID due to declines in the allowable annual cut, and increasing scarcity of fiber in the region. That continues to play out as limited production has put upward pressure and volatility on S-P-F prices.

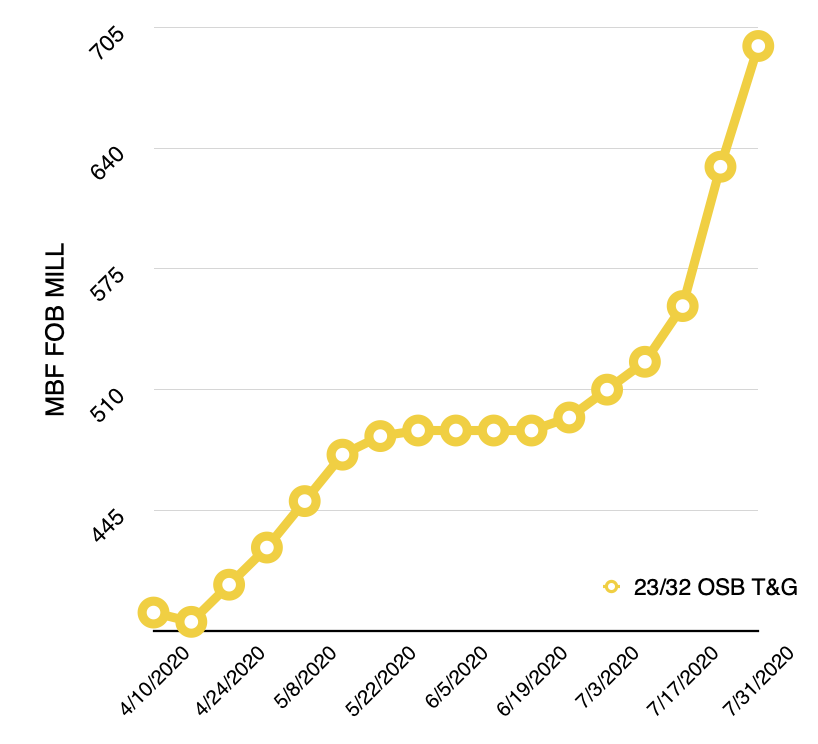

Maybe the biggest concern right now is OSB, as a surge in demand has completely outstripped supply. Shipments are out into September and developing holes for critical inventory items is creating major apprehension for lumber dealers. Producers are having difficulties staffing plants amid coronavirus concerns, and buyers are waiting in line to seize every available offering. High-grade lumber, including machine stress rated (MSR) and machine evaluated lumber (MEL), that have grown in popularity over the years, especially with structural changes in the International Building Code (IBC), have also been in short supply due to scant production. Truss companies, in particular, are struggling with getting the high-grade materials needed for their truss designs. I-Joist manufacturing has also been impacted as reduced productivity and even plant closures, disrupt supply.

The Numbers

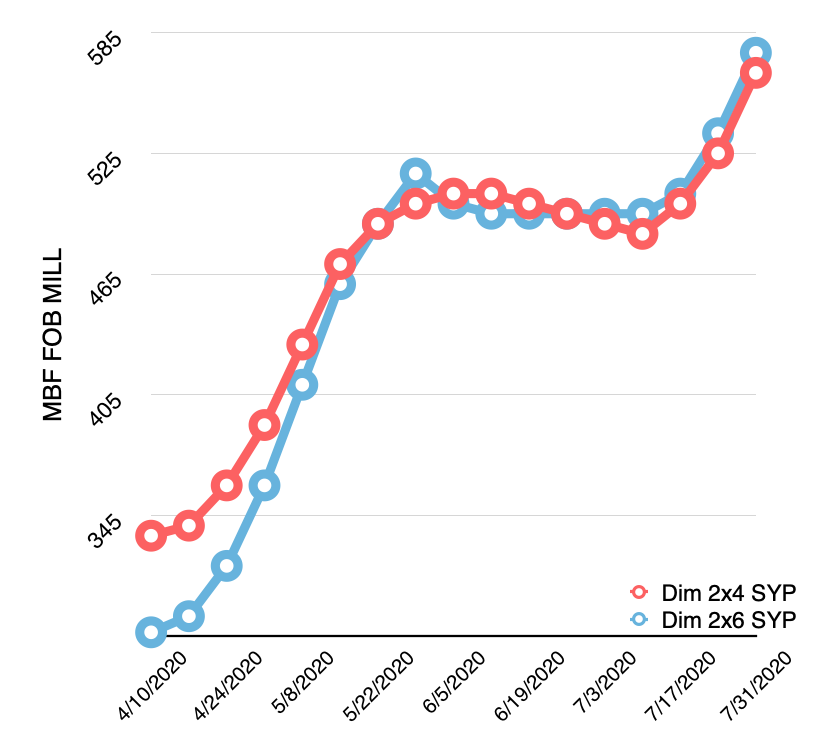

When we posted the mid-year report earlier this month, the Contract Lumber Commodity Lumber Price Index* had just crested the $400 threshold, landing at $405.84. Since then, we have posted five weekly updates to the index, and each week saw double-digit increases. In fact, the last two weeks have seen the largest weekly spikes ever recorded. Last week, our index blew through the previous record of $538.38, set back on June 1st, 2018. Today’s index sits at a record level of $567.68, besting the old record by nearly $30. The new record will only last a week. We have seen a 40% increase since our last report, and an 86% explosion in the 16 weeks since the market bottomed in the first month of the pandemic.

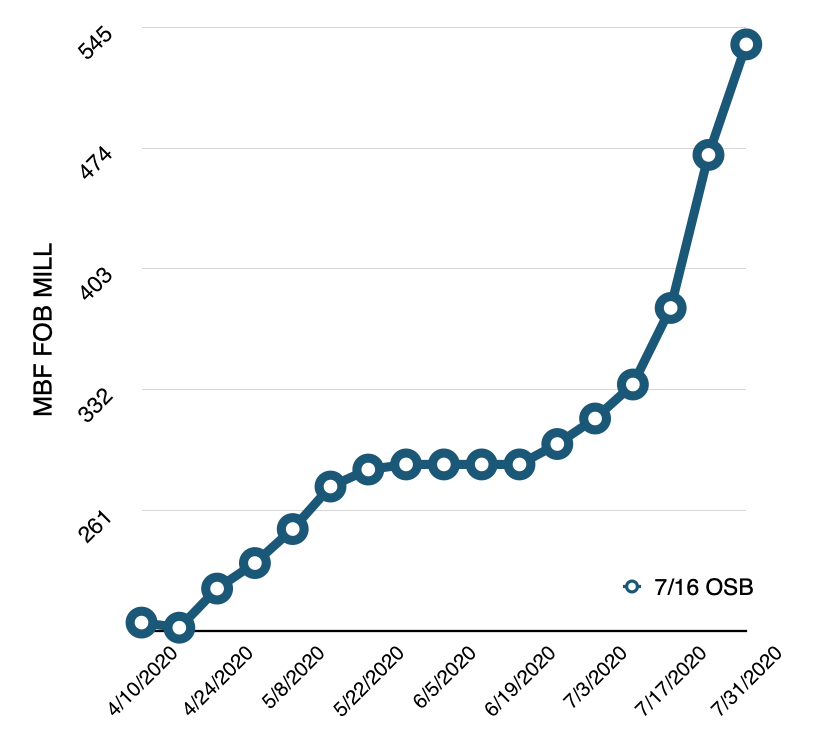

When you break down the price escalation of the individual products behind the index, the numbers seem even more outrageous. We’ve included a chart below to help bring this 16-week run, and its impact, into a focus. The In terms of individual costs on items, here is the cost in dollars and cents of several critical framing products – a 4x8 sheet of 23/32” T&G OSB costs $7.66 more today than it did January 1st. A 4x8 sheet of 7/16” has increased by $7.50. A 2x4 8’ SPF Stud cost $1.57 more today than it did the first of the year. A 16’ long piece of 2x4 SPF dimension has gone up by $2.04. And one 2x10” sixteen feet long has jumped by $8.45. To emphasize, those are the dollar cost increases since the start of 2020 of just a few essential framing items.

Where Do We Go From Here

In the short term – UP! At the time of this writing, RL-midweek is up across the board. With mill order files out well into September, short-term pricing has virtually no downside risk. More record highs are on the horizon. Moreover, nearly every lumber dealer is destined to run out of specific in-demand products, us included. We have been aggressively buying lumber all year long, trying to stay ahead of an incredibly active workload. Still, some things are beyond our control. We are diligently trying to take care of our building partners. What you can count on from Contract Lumber, is upfront, honest, and open dialogue to keep you informed, as best we can. The situation is fluid, changing every day. As I mentioned earlier in the article, we may not even know what is on an inbound shipment until it shows up in our yard. It’s frustrating – I know. We are asking that you work with us in understanding this intense and volatile situation. And if it’s any consolation, these are good challenges to have, verses many possible alternatives. Rest assured, this bubble will burst at some point, and we will get back to more normal market conditions. One thing for sure, we will all certainly look back at the year 2020 as anything but normal.

*Contract Lumber’s Commodity Lumber Price Index has been created as a tool for you to better understand the true impact of lumber market moves on the framing material costs of your projects. The index tracks seven key framing products. Each of these products is weighted in respect to their total cost of the framing material package. These seven products are then averaged to produce a single, trackable number called our Composite Lumber Index.

When you break down the price escalation of the individual products behind the index, the numbers seem even more outrageous. We’ve included a chart below to help bring this 17-week run into focus using numbers form our Southeastern markets as an example. In terms of individual costs on items, here is the cost in dollars and cents of several critical framing products – a 4x8 sheet of 23/32” T&G OSB costs nearly $10.00 more today than it did in early April. A 4x8 sheet of 7/16” has increased by $11.00. A 2x4 8’ SPF Stud cost $1.70 more today than it did the in the Spring. A 16’ long piece of 2x4 SPF dimension has gone up by $3.48. And one 2x10” sixteen feet long has jumped by $8.00. To emphasize, those are the dollar cost increases since the Spring of 2020 of just a few essential framing items.